The success tactics of the US’ 10 fastest-growing retailers

Although this may be the year that China takes the top spot, the US has long been the world’s biggest retail market. This year it’s estimated that sales will reach $5.5 trillion which is not to be sniffed at. That said there’s been plenty of change in the market with various big names either downsizing or leaving entirely as they fight to change up their approach.

What’s the secret to retail success in such a market? The truth is there is no silver bullet, no one-size-fits-all approach. According to NRF’s Stores magazine and Kantar Consulting, these are the 10 fastest-growing retailers in the US, which means they’re all doing something right. Here are the growth tactics that have helped them leapfrog the competition:

Image credit: Primark

1. Primark

Top of the list is Primark. Famous for its low-cost clothes, homewares, make-up and more, Primark is a powerhouse in Europe. Price certainly has something to do with its success, especially when so many households are feeling squeezed. But the company has also made smart choices when it comes to licensing with hugely loved franchises like Disney, Harry Potter, Game of Thrones and more.

The brand has a distinct advantage though in that it only started opening stores in the US in 2015. It still only has a handful of locations compared to other brands but is actively opening more. Each new store is a direct opportunity for the brand to multiply sales – a strategy that doesn’t necessarily work for retailers with existing large portfolios.

Unusually for retail today, Primark doesn’t have an ecommerce business. This is part of a carefully thought-out strategy though. For one it makes each brick-and-mortar store more valuable, and worth the investment, as it’s the only way the customer can shop. But the real benefit is the impulse buy. The low price point of Primark’s goods means there’s little barrier to filling up a basket as you browse the space. It’s a discovery model that doesn’t translate to online, but it’s these large volumes of sales that make Primark money.

Image credit: Bass Pro Shops

2. Bass Pro Shops

It may not be a name that immediately springs to mind when you think retail success, but Bass Pro Shops is doing better than most. The company’s niche of outdoor pursuits has stood it in good stead. Whether it is fishing or hiking or anything in between, these activities generally require equipment to complete – and therefore create sales.

It’s also worth noting that customers who become truly passionate about their hobbies are happy to spend regularly in upgrading their equipment or trying out new products that might help them improve. By presenting itself as a dedicated expert, Bass Pro Shops can use its knowledge to draw customers in.

The company has also benefited from the acquisition of rival Cabela’s which was a massive boost to its impressive recent growth. It’s a move that will also ensure that Bass Pro Shops holds as big a portion of the market as possible, rather than losing sales to rivals.

Image credit: Build.com

3. Build.com

Two things come to mind when we think of the housing market. One is that home ownership is a struggle for many, although this is The second is that this fact means that owning a home has become more of a status symbol for those able to take that step. Home owners are willing to spend money on making their house as good as possible. A difficult housing market also means home owners may opt to make adjustments to their existing property rather than look to buy somewhere new.

This is good news for the likes of home improvement company Build.com. As an online only company, it does not have the costs and challenges of a portfolio of spaces. This also helps it to grow faster as its customers can be anywhere (as long as it can deliver to them).

What’s really helped Build.com though is its investment in tech that helps customers buy. The company understands that’s it’s important for customers to be able to visualise how their new lights or taps or whatever might look in their home. Without showrooms to direct them to, Build.com has created an AR tool that lets them see how the product might look, and work, which increases confidence to buy.

Image credit: JORDAN STEAD / Amazon

4. Amazon

It’s unlikely that this name surprises anyone. Amazon is one of the biggest names in retail everywhere. In fact, you might wonder if it really has room to keep growing in a significant enough fashion to make a list like this.

Thing is Amazon has been keeping busy. A big chunk of growth came through its acquisition of Whole Foods Market, which added a bunch of stores to its arsenal. It’s also given it a whole new business to integrate, but also opens the way for other logistics options around pick-up. This is important because Amazon’s retail business is basically all about delivery. Its success hinges on its ability to get products to people fast, wherever they are.

Amazon has also moved into a new physical retail area with its Amazon Go stores. These tech-powered spaces for walking-in and out without queuing up to pay are considered by some to be the future. One thing is for sure is that Amazon is betting big on them as a form of convenience as we get more time-poor.

And of course, it’s still finding ways to grow its long-standing ecommerce business. Some of this may be new Prime subscribers, but some is down to getting existing customers to buy more. The best way to do this is, once again, through convenience. A seamless shopping experience and fast delivery brings customers back again and again.

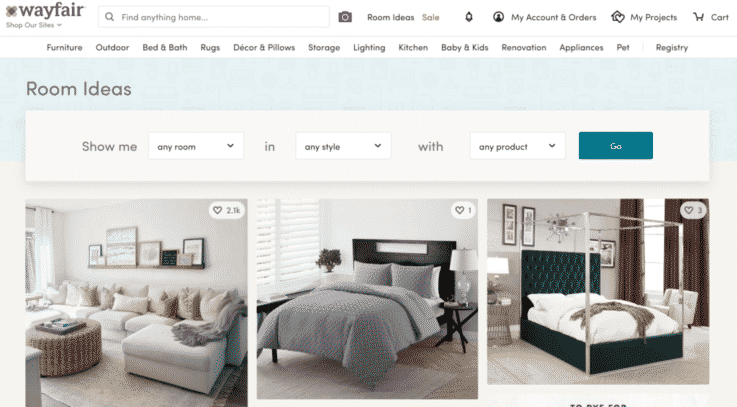

Image credit: Wayfair

5. Wayfair

Home furnishings company Wayfair is one of the ecommerce success stories in this list. The company’s success has been in using tech. from AR to VR to 3D, to help customers shop furniture and décor from thousands of brands. These tools mean customers can see what products might look like in their home before they buy. This helps to give them confidence in what they’re buying.

The website also hosts Room Ideas which are aspirational and inspirational images of different home set-ups. Customers can click on the different products in the image to find more information and buy. It’s like a mix of Pinterest, Instagram and ecommerce. By letting customers see how product might sit together Wayfair also helps to drive up order value as people want to recreate the whole look.

Last year the company launched ‘Way Day’ – it’s equivalent of Amazon’s Prime Day. Way Day sees Wayfair runs deals on its website for 36 hours. Last year this saw quadruple the normal sales for a day in March. It’s also a clever way to draw in new customers who may not have used Wayfair before. Again though Way Day also shows how Wayfair is not sitting still when it comes to tech as this year’s event incorporated livestreaming.

The company is also now moving into bricks-and-mortar with its first permanent stores. Whilst this may not make a big difference to growth immediately, it’s a smart move when Statista estimates that 87% of home furnishing sales took place in stores in 2018. By giving customers stores to visit Wayfair could grab a much greater share of the market.

Image credit: Tapestry

6. Tapestry (formerly Coach)

Formerly known as Coach, Tapestry has helped to boost its growth by acquiring the much-loved Kate Spade brand. The move also helped to give Tapestry greater control of the market when it comes to entry-point luxury handbags and the like. By reducing the amount of competitors, it ensures that more sales go through one of its brands at a time when the premium handbag industry is seeing growth.

Overall though the company has struggled in terms of value recently. A strategy that’s focused around full-price sales, with reduced reliance on promotions or wholesale, seems to be helping Tapestry get back to growth. When dealing with goods of a certain cost bracket price is not the factor to focus on.

Customers need to see the products as aspirational, luxury goods. If they’re discounted too much, then there’s an argument to say that they become too widespread and lose that element of desirability. Other growth drivers have been initiatives like Coach Create which lets customers design their own Coach bag. This gives them more ownership of the product and may help convince some to pay the associated price for it.

Another pivotal decision has been the reacquisition of various arms of its business. This includes buying back the Coach business in Australia and New Zealand, and Kate Spade and Stuart Weitzman in China. By having direct ownership of all facets of each brand, Tapestry can better control what happens with them and make sure it is taking advantage of every international opportunity for growth.

Image credit: PetSmart

7. PetSmart

As with some others on this list, PetSmart got a major growth boost through a large-scale acquisition. In this case it was Chewy.com, a highly-valued online pet supply retailer. At the time it was the most expensive ecommerce acquisition ever.

The result is that PetSmart now has top-notch ecommerce chops. This includes a 24/7 customer phone line/chatbot for tips and help when shopping. This level of service helps stop customer clicking away to a competitor because they don’t know what to buy. It also fits in with the customer by operating 24 hours, rather than expecting the customer to fit in with store opening times.

PetSmart also benefits from targeting a valuable niche. With younger generations either waiting longer to have children, or choosing not to have them at all, spending on pets has grown. Apparently more than 70% of US homes have a pet of some description, which outweighs those with children. Owners are happy to spend more to give their furry friend the best possible life and that gives PetSmart a major opportunity.

Meanwhile its stores remain a valuable part of the proposition when it comes to services. From grooming to healthcare to training, these physical locations can tap into all sorts of pet-related offerings. Humans tend to be creatures of habit which means that if someone is using PetSmart for its services they’re likely to combine visits with shopping.

Image credit: Five Below

8. Five Below

One area of retail that continues to hold up well against changes in the market is the discount store. It’s a no-brainer as to why – price is still important for many shoppers. Five Below’s USP is that nothing in its stores cost more than $5. The company deliberately targets teenagers and young adults and so a low price point is vital.

Its product array is also carefully chosen to appeal to these age ranges, and to capitalise on new trends as they emerge. The price point means that kids, and parents alike, are in a position to keep going back to get something new. This is a big sales driver when it comes to things like trends as these can change fast and cost a lot.

Although lots has been said about the decline of the shopping mall, and its importance in retail’s future, for Five Below the mall has been the target for its 750+ stores. Volume of sales is important for the brand and therefore it needs to be positioned in places that are easy to get to and have lots of footfall.

The company also has an ecommerce side, which again helps it capitalise on the latest trends by offering customers an affordable option when they search online. It’s these kind of low value sales that the likes of Amazon struggles to always fulfil in a cost-effective way because of the challenges around delivery. This gives Five Below a major advantage.

Image credit: Ulta Beauty

9. Ulta Beauty

Beauty retailer Ulta has been on a big brick-and-mortar growth drive with hundreds of stores springing up in recent years. This looks set to continue for the near future.

Beauty is one category where the ability to see and test a product is still important for many shoppers. Opening physical stores has given Ulta a way of attracting more customers than it might online alone. It also lets the company provide additional services like hair styling, skincare and brows that online can’t compete with.

That said the company is also investing heavily in its digital offering with acquisitions in AI, AR and more. The website gives Ulta the opportunity to offer more brands than it can instore alone. It’s also a good way to test the response to new brands which can help with decisions on what to bring into store.

While the beauty category is highly populated Ulta has differentiated itself by selling both premium and mass beauty brands. This means customers can get everything they might want in one place. It also means that anyone can shop there – whatever type of beauty they’re into. Service is also key. Even with the mass market beauty brands, Ulta wants customers to have a higher level of experience than the drugstore of old.

Ulta has also seen success through exclusive partnerships with up-and-coming and online beauty brands. As a result, its stores are often the only physical place customers can go to get their hands on these goods. They’re also somewhere they can come to test them out before they buy, which can mean that Ulta picks up a sale that could have gone to the brand’s online business.

Another big success factor is Ulta’s Ultamate Rewards programme. With more than 29 million members it’s a huge source of customer data, which directly feeds back into company decisions. The programme is free to enter with customers getting points for every dollar spent. The ability to accrue points faster is tied to how much a customer spends in a year, which encourages higher spends in store.

Image credit: Pet Retail Brands

10. Pet Retail Brands

The value of the pet sector is clear from the fact that there are two such brands on this list. As with PetSmart, Pet Retail Brands is benefitting from an increase in pet ownership and greater spending on pets. Some of this is driven by the desire to give our animals a better quality of life than they may have had in the past. This includes things like premium food brands rather than the standard stuff in a tin.

Unlike PetSmart, Pet Retail Brands hasn’t seen growth through an acquisition, but it was formed through the merger of Pet Valu and Pet Supermarket in 2016. This made it the third largest pet retailer in North America. In comparison to its competitors though, Pet Retail Brands is king when it comes to the smaller neighbourhood pet store with more than 1,000 such spaces.

This gives it the advantage of being able to get in closer to where customers live and work compared to big box names. It makes it easy for shoppers to pop in as they go about their lives. There’s also perhaps a perception of being more of your ‘friendly neighbour’ than its competitors, which may appeal to certain shoppers. This is especially the case with millennials who are looking for expert advice on the best products for their pets.

What’s driving their growth?

Lots of things. Acquisitions certainly have their place in jumpstarting a retailer’s growth, particularly if they’re already well established in the market and perhaps have less elbow room than some. They’ve also enabled some of these brands to become the dominant player in their field, which helps to boost sales.

Knowing your niche is another major driver of growth. Most of these brands operate in different parts of the industry, which goes to show that you can find success in almost anything from make-up to fishing rods to pet food. The reason these names are on this list, and not their competitors, is that they’ve done more to make customers choose them. Expertise is one approach that works well here. Another is using tech as a tool to help make buying as easy as possible.

But, as this list shows, there is no single universal approach. Ecommerce is vital to Amazon’s growth but doesn’t make sense for Primark. Lower-value goods boost Five Below, but discounting doesn’t work for Tapestry. This is why understanding your customers and the role you are fulfilling is so important.

You don’t have to be all things to all people. Primark might be losing some sales by not being online, but with its current business model every online sale could potentially lose the company money. The smart move is not being moved to do something that doesn’t add value. That’s the best strategy for success.

Want more retail growth insights? Here’s how 15 of the UK’s fastest-growing retailers are doing it. Get in touch to find out how our Insider Trends consultants can help your retail business with its own growth strategy.