Why Location Data is Changing Everything About Advertising

Advertising is a familiar concept to us all. But just because it’s familiar doesn’t mean that it always stays the same.

As the way we shop, work and live evolves, so does the world of advertising. And this opens up a world of new opportunities to connect customers with the things they want to buy.

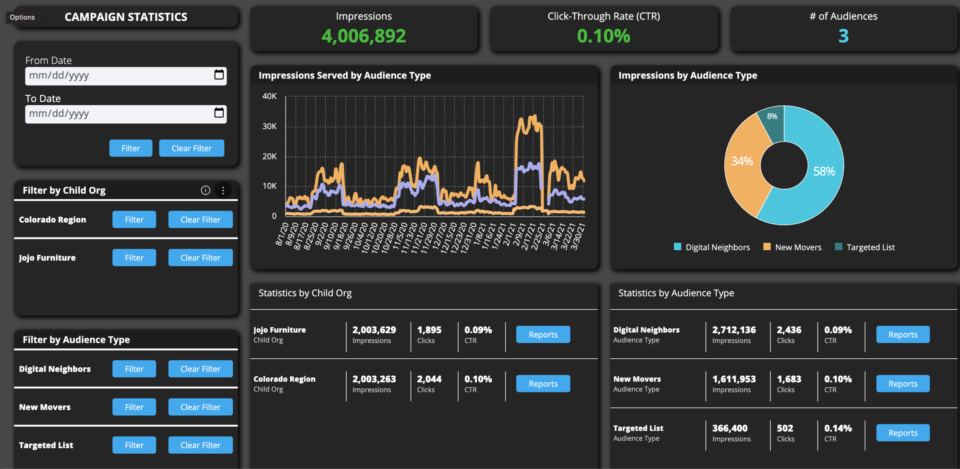

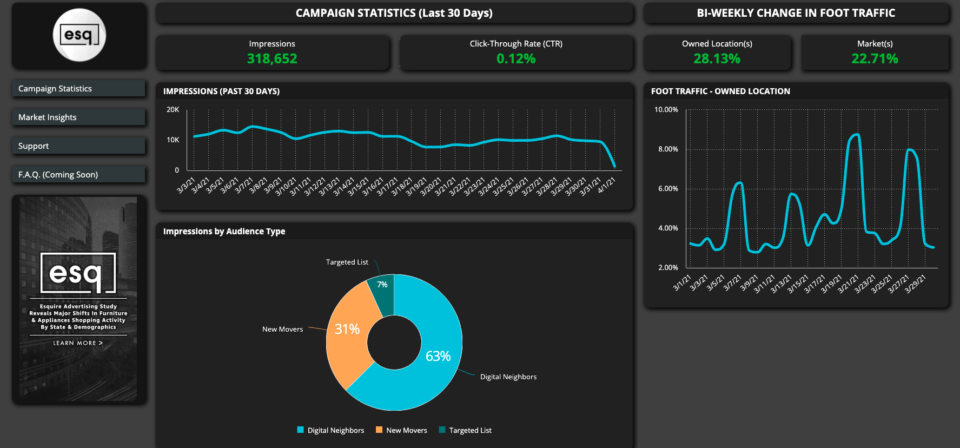

Esquire Advertising believes that one way to do this is through individualised location data. By understanding where customers are, and when they’re shopping, retailers can target them with localised adverts that actually converts. But you can also start to even pre-empt who your future customers might be and start building relationships with them.

We spoke to CEO Eric Grindley about how data is making advertising smarter than ever and using location data to predict shopping behaviours.

Eric Grindley, CEO, Esquire Advertising

Can you describe what Esquire Advertising does in a nutshell?

We are an ad tech company that utilises large scale data aggregation to pinpoint individuals and individual devices out in the wild and then serve ads to whoever your most likely consumer is in a given month.

What areas of retail do you work in?

Retail is by far our number one category at present. We also work in higher education, the automotive industry and occasionally in politics and financial services.

The home furnishings category in particular is big for us. We work with furniture retailers, furniture manufacturers, bedding retailers, bedding manufacturers, appliance retailers and appliance manufacturers.

One of the things that we’ve found over the last five years or so is that the manufacturers are really driving advertising in the retail industry.

For the most part, they’re usually the ones putting up the bulk of the money through cooperative advertising dollars. At the same time, they lack the visibility into where those dollars go and how they’re spent. A lot of times they’re just handing the money over to retailers and then they just don’t know what happens, or how those advertising dollars are being applied to attract their target customers.

How does your technology work?

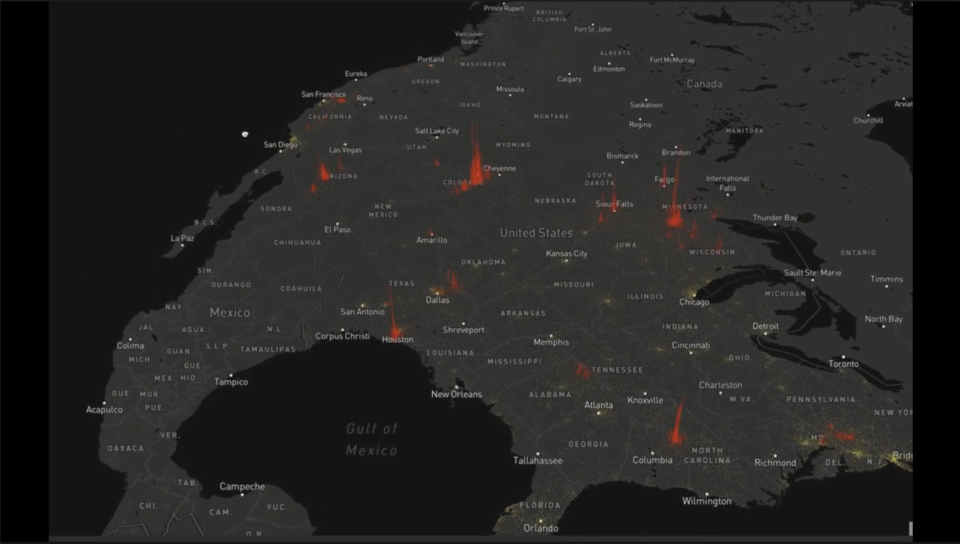

We capture the geolocation signal given off by devices at a mass scale.

We’re monitoring about 500 million internet-connected devices a month in the US. About half of those are strictly mobile devices, and the rest are tablets, computers, smart devices, watches, etc. We capture that data and map the devices to a household address (based on dwell time).

We understood early on that we needed to acquire a massive amount of data in order to really capture these devices and where they go. As such we aggregate a lot of data, first and third party, in order to better educate the dataset.

If you only have one piece of information, you’re going to have breaks in the data. You might see the device for a minute and then it’s gone, and you don’t see it again for another hour.

We want to see that device every 30 seconds. We want to be able to see your drive pattern. We want to be able to see what route you take to go shopping and how long it takes you to get there. In order to do that, you have to get your hands on as much data as possible.

One thing we have to do is clean the data. There are hotspots all over the US, but the carrier can’t pinpoint a location, so they’ll just drop a device in a certain place. If an app doesn’t have location services, they’ll sometimes just attach a random geolocation spot.

There are a couple of ways we can use that data.

We can identify who is visiting your store by hand drawing frames around it on the map (via satellite). We do this within four feet of the interior wall, so that we don’t have to worry about echo because location services data can bounce around.

We can also use the data to estimate how many devices in total are in the local area and what percentage of that are you capturing at the store level.

What are the main things that retailers are getting wrong about advertising?

For the last 20 years the retail industry has been spending money on advertising without ever having any significant data point to point to as to why they should be doing that. It was just a case of ‘you should do this’.

They had absolutely no measurement. There was no eye towards attribution. Nobody cared because for the longest time retail was just always growing and as long as they were growing, they felt their marketing must be right.

There’s an adage that says ‘50% of our marketing isn’t working, we just don’t know which half’. For the most part, once we start digging in, we find that more than half of a retailer’s advertising wasn’t actually working.

Retailers were also relying way too much on traditional advertising like print ads in the local newspaper and sending out circulars where they hope for maybe 0.5-1% return on investment.

We’ve spent a lot of time educating retailers on ways to do that better. Even within the retail space, there were companies that were doing digital advertising for clients but not in an effective way.

There was much more of a national strategy to almost every account that they dealt with. Whereas we take a custom and local strategy for every individual retailer. Even when we’re dealing with some of the largest retailers in the US, we’re looking at individual store locations on a case-by-case basis, rather than saying, ‘this is your strategy for North America’.

That’s because each location is a little bit different. The shopper is a little bit different. The customer that you have is a little bit different. If you take the same approach everywhere, you’re going to miss the mark.

For us it’s always been an approach of looking to the data, let the data do the talking, let the data tell you which customers you need to go after.

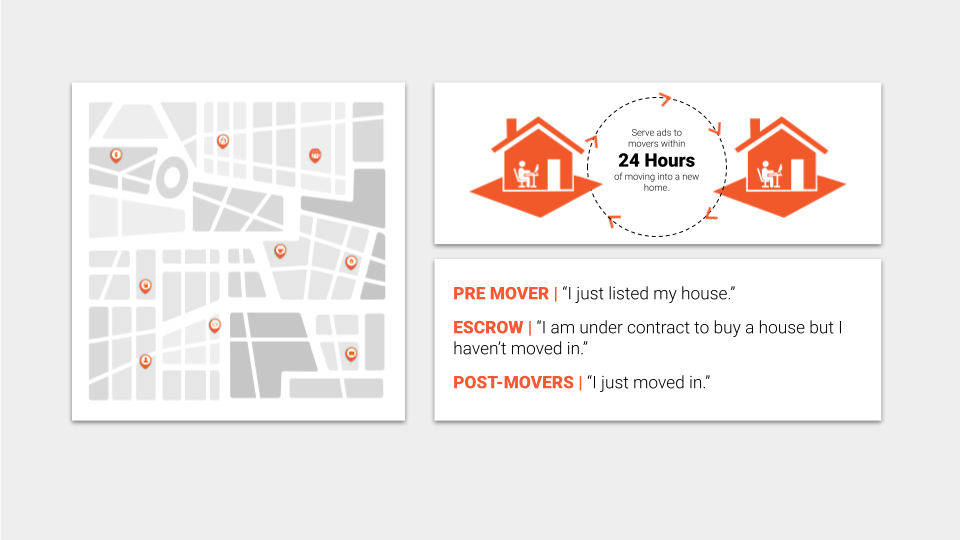

For example, there’s currently around 50,000 plus movers a month in Dallas, Texas. All of those movers are in the market to potentially buy furniture because they’re moving. Not all of them are in the market to buy from your individual store.

In the sea of all this data, you have to find who are the most likely people for your business. In the past you’d send a direct mail to all these people, which is a very costly endeavour and you ultimately have some negative return on investment where you’re overspending.

If you could figure out who are the 4,000 movers this month that are most likely to shop at your store, you’re going to be that much more profitable off that media buy.

Our goal is to get our clients to save money while still growing their stores and having really effective marketing communications.

How does the localised strategy differ from a national one?

As an example, a big national furniture retailer in the US buys all of their Google Search ads based on a national strategy.

When we go up against them for local retailers in that same market, we’re able to get the local mom and pop retailer to be on the top of them in the search rankings by spending less money because we’re localising every single ad.

We had a retailer in Pennsylvania come to us and say they want to sell more of an American leather pull-out sofa because they make a really good margin on it and the staff are really good at selling it.

They had three store locations, so we looked at the past purchasers of that sofa for each store individually and found that the people that were buying that sofa in each individual store location were slightly different.

Those slight differences make a massive difference in how an ad engages and ultimately what the result is in the store.

We ran three different ad campaigns for the three different stores, all geared towards finding the people that would buy that specific sofa, and we increased sales of that individual product in each of those three stores. This made a real impact on their bottom line because it was one of the highest margin items that they had.

What are the most innovative applications of your systems so far?

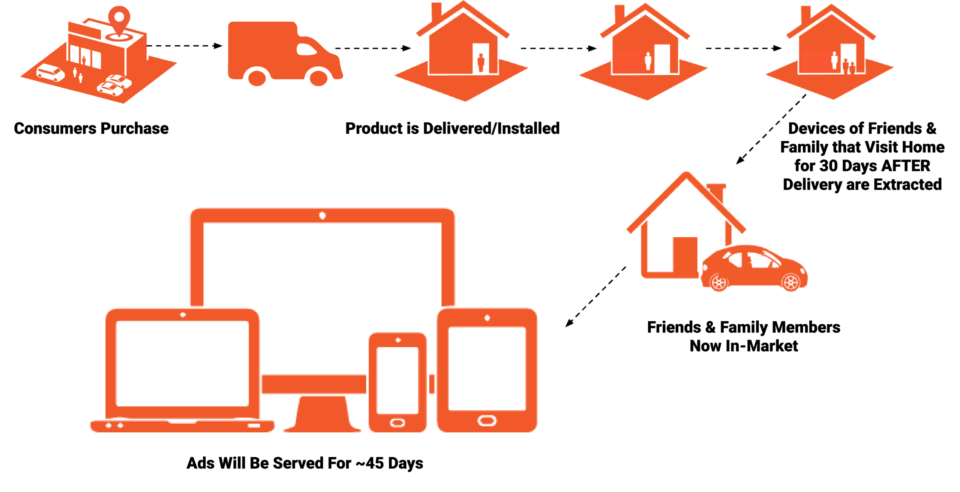

One of the interesting strategies we employ, we call “Friends & Family.” Everyone has influence. Our influence varies from person to person, but we all have influence.

Some of the best and biggest influence that you have is over your individual friends and family members. If I go and I buy a new car and my friends see the new car, they’re going to start thinking, ‘should I buy a new car?’

We first tapped into this in appliance retail. If someone bought a new set of appliances, the system would look for all the friends and family members that visit the house for the next 30 to 45 days. Those people would then get served with an ad for new appliances across all mediums.

It had real effect because we’re piggybacking off of a real-world review.

If I just bought all these new appliances, we’re going to talk about it, and you’ll ask where I got them and if I’m happy with them etc. Retailers had this real in-person review of their product and service, that we could then build off with an ad.

It’s interesting because as you start track the movements and push ads to these people, you can watch where they go, and you can see when that influence starts to take over.

We’re now starting to move into predictive services and how we get ahead of the shopper.

For example, if you go into a hardware store, you’re about five times more likely to shop for furniture in the next 90 days as compared to the general public.

So as a furniture retailer you could target people who visit the hardware store and be ahead of the game.

The next challenge for us is predicting based off of your competitors’ customers.

In the next few months, we’ll be launching a service called Competitors +. It looks at a combination of your competitors’ customers, plus their neighbours.

One thing we never knew about a competitors’ customers was whether or not they bought anything. We knew they were shopping, but we don’t know if they made a purchase.

What we do know from our neighbours’ campaigns is that if I buy my neighbours are more likely to buy too. In addition, your neighbours tend to be a very demographically similar audience to you, which means if you bought something, they are likely to be ideal targets.

You’re basically front-loading your audience with the neighbours of those people that are out there shopping.

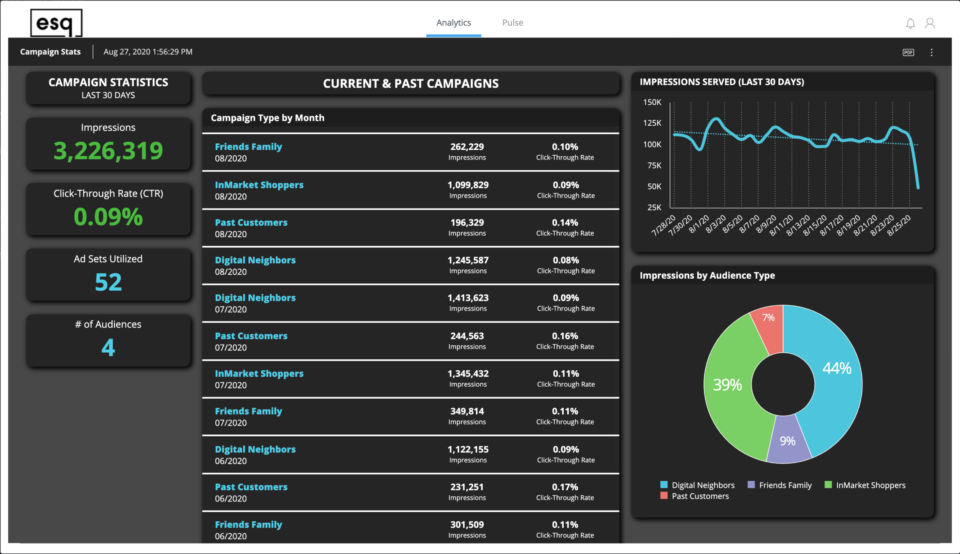

What sort of ROI do your clients achieve?

Almost all of our campaigns will always do better than a 10:1 return. For most of our clients it’s in the mid-twenties, but the bigger the brand and the store, the more reach they have so the bigger the results.

The biggest factor is whether the retailer can provide us with the data that we need in order to optimise. The big difference between what we do and what everyone else does is that we match up your in-store sales to your ads so that we can see the dollar for dollar match.

This way you can get some great optimisation because you’re not optimising to what I call fake KPIs like clickthrough rates. If you don’t understand, who’s actually buying, who cares what the clickthrough rate is?

Sometimes when you run an e-commerce ad, the ad with the worst clickthrough rate is the highest performing on sales. It just goes back and forth.

The only thing that matters is whether or not people are buying and that they’re buying at a rate that justifies the ad spend. If they’re not buying at the rate that justifies the ad spend, then you need to cut it and start over.

Most retailers have no idea from a brick-and-mortar standpoint, what the return on ad spend is for search traffic. Even from a direct mail standpoint, unless the person walks in and hands you the piece of mail, you have no idea what actually influenced them to get to the store.

What are your thoughts on brand awareness versus specific calls to action?

I think that almost every retailer should be doing a combination of both.

In the US, there are two distinct shoppers – those people that want something now and are willing to settle for what’s immediately available, and there are those that want something specific and are willing to wait if needed.

If you do custom upholstery or room design or whatever, that’s a brand image that you have to be out there promoting because that customer exists and you don’t want to lose them.

While at the same time, all of your advertising can’t be long tailed. If you spent every dollar on branding, you would be losing money because branding isn’t going to bring people in tomorrow. You still have to have this strong call to action that’s going to bring someone into you today.

One of the coolest things about movers is that they don’t have necessarily have brand loyalty when they move to a new market. This gives us an interesting opportunity to build a brand loyalty so that when you capture that customer you have them for more than just this initial purchase, you’re going to have them for the purchase that they make in the next 12 months, 18 months, 24 months.

If you only talk to them about the sale, then they don’t have as much brand loyalty. They’ll just come in and buy that one thing and be gone. You have to always be supporting both sides of the equation.

What is your vision of advertising in the future?

My moonshot idea has always been that consumers would get a piece of the advertising dollar and the ability to monetise their own data.

You can use my data. You can monitor me online. You can know everything that I click on, interact with, and then when you use my information, you pay me a fractional percent. I think that that’s the long-term future of advertising around the world.

At some point, consumers are going to wake up and go, ‘we’re the product. You’re using my data. I should get some of that.’

I think consumers would be more willing to provide more data if that was the case. If you had insight into everything that person was buying, they would only see relevant adverts, which means you would need less ad spend.

Our next big push is into OTT and CTV. We’re working right now on integrating our technology with some really big, connected TV providers.

I think that’s going to make a big difference for our clients because even from an OTT perspective, you can only get so targeted and there was really no ability to match it all back and understand what was working or not.

We’re also hoping to be able to bring the cost of this type of advertising down so it’s more accessible to companies who don’t have hundreds of thousands of dollars to spend each month with an OTT company.

Book a call with one of our consultants and we’ll connect you with companies like Esquire Advertising that can help you sell smarter.