3 months to 1% revenue recovery risk-free? Time to Discover Dollar

One percent. It doesn’t sound like a lot. But when you’re a multi-million, or maybe a multi-billion, dollar business passively losing one percent of your revenue every year starts to add up. The cleverly named Discover Dollar is on a mission to help those retailers recoup money lost through everyday business practices of promotions.

If that’s not enough it promises retailers a risk-free five time return on their investment. And the system can be up and running in a matter of months. It’s a pretty compelling argument, so why wouldn’t you want to know more?

We spoke to founder and CEO Subrahmanya Rao to find out exactly how Discover Dollar does it, how revenue leakage has become an issue, and what issues the company is tackling next:

Can you describe what Discover Dollar does in a nutshell?

Discover Dollar is a retail analytics company helping the large retailers of the world to identify revenue leakages and overpayments. We build intelligence into the buying process for the retailers.

All of these large retailers run a lot of promotions in their stores like ‘Buy One Get One Free’ or ‘20 percent discount’ or maybe a special promotion for a new product launch. Four out of five times these promotions are paid for by brands and not retailers themselves. The brand negotiates a deal with the retailer that says, ‘we will pay X amount of money for this promotion’ or ‘X percent for every product you sell during the promotion’.

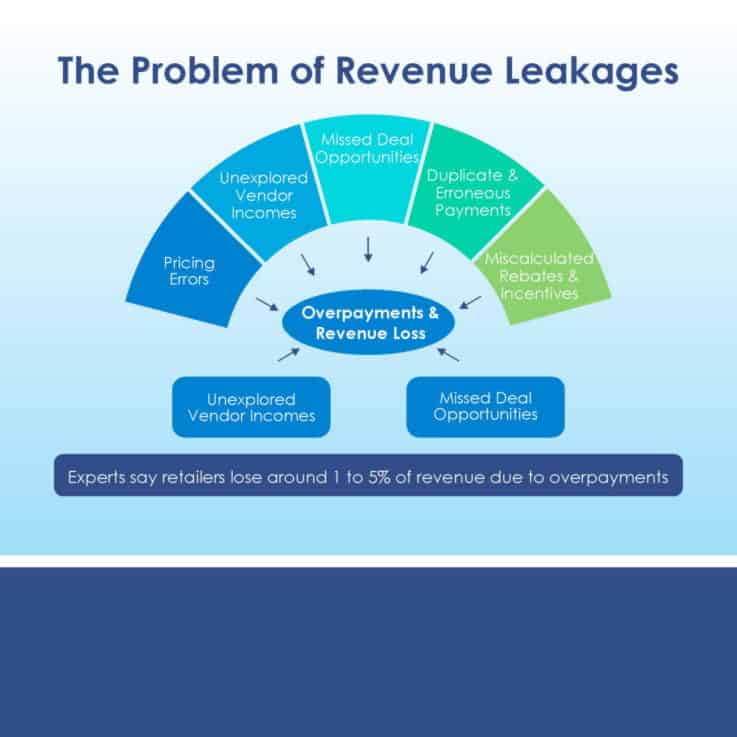

The retailer then executes the promotion in store. Once the promotion is complete they collect the money from these brands based on its performance. These negotiations are all on email and between these and the time to collect the money there is a huge gap. One to five percent of this money gets lost for multiple reasons. These include the fact that it’s unstructured, it’s hard to keep track of and it’s all based on performance, so you cannot collect the money early. So, for many different reasons the money gets lost which has a direct impact on their profits.

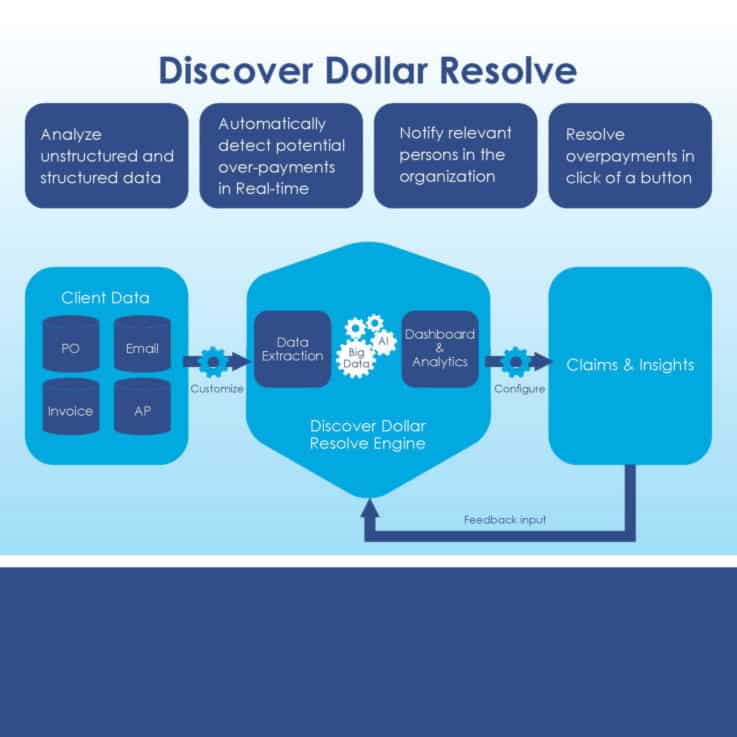

We have built a machine learning platform which can automatically extract the relevant information from these emails and contracts – what the product is, what a promotion is going to be to, when the promotion is going on, what money is the retailer getting – and help retailers to see and collect this money. This happens in near real-time because of the data harnessing power we have.

At the click of a button they can go and collect the money from those brands. Everything that we collect is a direct impact on their profit and cashflow. We have helped our customers save $300 million of revenue leakage and this is just the tip of the iceberg. We’ve realised that we’re just solving a very small problem and we can solve many other things as well.

Are there certain categories of retailer where your product is more applicable?

We see this problem across all of retail, but in different ways. We primarily find the problems with promotions relating to the pricing are in grocery. But for fashion we find they miss a lot of money on markdowns. When they run clearance sales for the previous season the discount they give comes from the brand and this money gets missed big time by the retailers. For electronics we also see a lot of this especially with toys and some of the small electronics.

With larger electronics there is price protection. So, when Apple launches a new iPhone the older one gets a price cut. If I am holding inventory of the old product I need to get the difference between the new price and the price I have paid for them. We identify different types of money for different retailers because the nature of the promotions are all so different.

Can you tell us which brands you’re working with?

We are currently working with Target in the US and with Metro Cash & Carry in Germany. We are also in the early phases of working with two retailers in India, as well as conversations with several other large retailers.

Is there a certain size of business that makes sense for you to work with?

We typically work with retailers with more than $100 million in revenue. If some smaller retailers are really keen and want us to work with us, then we usually are open to have those conversations as well. For a small retailer this problem is much bigger. It’s not even five percent, sometimes it goes up to 20 percent, because they don’t have systems in place like a Fortune 500 company. Their processes are a lot more optimised, whereas in smaller retailers they’re not.

What’s the set-up process like?

One of the biggest challenges typically when working with very large retailers is getting the data. Getting a buy-in is not a problem for us. Where we usually see a bottleneck is when we have to get the data. We usually ask our clients if there is somebody who can drive this internally because we need a lot of data. Usually we get somebody who is like a champion who starts clearing these bottlenecks because at the end of the day this is bringing them real money.

We also run a three-month pilot with them where we just take some data from the important areas and show them the value to prove to them that this will bring them a ROI. We promise our customers a minimum five times ROI. Our business model is that we take a percentage of money that we save. Those three months will show to us and our customers if this is really working or not and if it is then it makes it a no brainer for us to work together.

We then onboard them as a full-time customer, which usually takes another three months. But it can happen much faster as well. We have had one scenario where within six weeks we were fully up and running. When onboarding we typically do a one-way integration getting data from their systems to us. It is challenging when we have to integrate our product back to their system.

We can use data in any form possible. It can come in unstructured data like emails, it can be a CSV, it can be an export, it can be in any possible form because we have connectors which will extract data from there and start working on it.

What kind of returns do customers see?

After speaking to customers, we realised that they don’t understand that revenue leakage and overpayments are different. Overpayments typically happen on purchases they make so maybe they were supposed to pay £10 for something but they end up paying £12, so it’s an overpayment. Whereas the revenue leakage part is what they’re supposed to receive from the brands. Overpayments we typically achieve one million for every billion dollars whereas revenue leakage is usually one to five percent of the promotional funding.

What are your plans for developing and enhancing the product going forward?

Right now, it’s a product but we have very good potential to become a platform. We are laser focused on solving revenue leakage and overpayment as a problem looking into data. We say to our customers ‘if you give us your data we will find you money and if we find you money you pay us money’. It makes for a very clear argument.

As part of the process we are getting data like purchases, promotions, negotiations, timelines and so much more. This is not only helpful for us for finding revenue leakages and overpayments, but we can also provide them with much more intelligence. When we know that historically they have done X promotions we know which are the vendors that have been very good at giving them promotional revenue and the typical timeline they take to make these conversations.

For example, say there is a merchandiser who is negotiating with Lego for a Christmas deal for toys in Tesco and he does a deal in November and this promotion is very successful. Next year though maybe he has moved to another company or internally to another division. What happens typically is that intelligence moves along with the merchandiser which is a loss for the company. With our solution what are also working on is business intelligence.

From our data points we know when those buyers started the negotiation and when it ended and how much the negotiated price was and what money Tesco made out of it. So, we can send a recommendation next year around the first week of November saying to the new merchandiser ‘why don’t you start this promotion discussion with Lego which was successful last year’. All the information is available for them and it’s just a click of a button for them to start this conversation. It helps them to increase their profitability.

This is something which they really need in the age of Amazon and retail being so competitive and the margins being less. The only way that they can make more money is to be able to squeeze more money from the suppliers of the brands. Whoever does that is winning in the retail industry now and we will help retailers to ensure that that intelligence carries through. Because when huge retailers are dealing with millions of products, intelligence on each product is something humans cannot remember.

Have you had any thoughts about how blockchain might affect what you’re doing?

Blockchain is something which is on our radar. We are actively having conversations primarily to help create a ledger which is shared between both the vendor and the retailer. One of the problems right now is that the money that they’re collecting has to be made as an entry in both the books. For example, if Tesco is running a promotion for Sony they will charge them £50,000, so Tesco makes an entry in their ledger for that £50,000 and Sony makes an entry telling them they have to pay Tesco £50,000.

What we’re trying to do is use the blockchain in future to make the retailer’s ledger updated and share that information with their suppliers and ensure there is a minimal discrepancy happening. This becomes a seamless activity between the retailers and the vendor whereas they can start focusing more on new promotions rather than focusing on collecting after the fact.

We are planning it in a phased manner. We are doing something called statement audit as part of our broader product. That is something which we want to start as early as January 2019.

What are the benefits of being located in Bangalore?

Bangalore is easily among the top 10 start-up hubs in the world. There is a huge amount of the talent we want available in data science and machine learning. The other thing is that Bangalore has become a hub for Global Incubation Centres. More than 60 percent of Fortune 500 companies have a presence in Bangalore either as a back office or a research centre or R&D intelligence and data science.

This is actually helping us – we were able to crack the Target deal because they had an office in Bangalore. It creates an opportunity for us to have conversations with these companies’ employees and see what problems they’re having. Also, we can engage them when we are building things because we need to build the right things and customer input can help.

Are there any other retail tech companies that you think are doing interesting things?

One company is Xeno, who are personalising marketing. They’re after a market which is already there, but the way they’re solving the problem is very innovative. Whodat are a company working in AR. They’re helping retailers, especially furniture retailers, to make purchase decisions much faster. Consumers can see how furniture fits into their house just using their phone.

There’s also RetailQuant in Germany, which is a company that is helping retailers get smart information. They place a small sensor at the checkout which helps retailers and brands to know what kind of buyers are coming and buying what kind of products. It gives them a lot of demographic information. Amazon has information about every person who buys from them so they’re trying to get that for offline retailers as well.

Images courtesy of Discover Dollar