Does Shein’s forgotten store hold clues about its plans in France?

News that fast-as-possible fashion retailer Shein is planning to open a series of physical retail spaces in France has caused all sorts of commentary from the retail industry (most of it negative).

One thing that keeps cropping up in reporting is that Shein has run pop-ups before but never a permanent physical store.

Except for the one that has been in Tokyo for the last three years, that is.

Now maybe it’s not considered a permanent store (although I’m pretty sure that’s exactly what it was billed as) or its showroom concept means people discount it.

Or maybe everyone has simply forgotten about its existence seeing as even Shein never talks about it.

It is real though – I’ve scouted it – and I can’t help but wonder why no-one is talking about it and whether it holds any clues about Shein’s strategy in France.

Altering perception

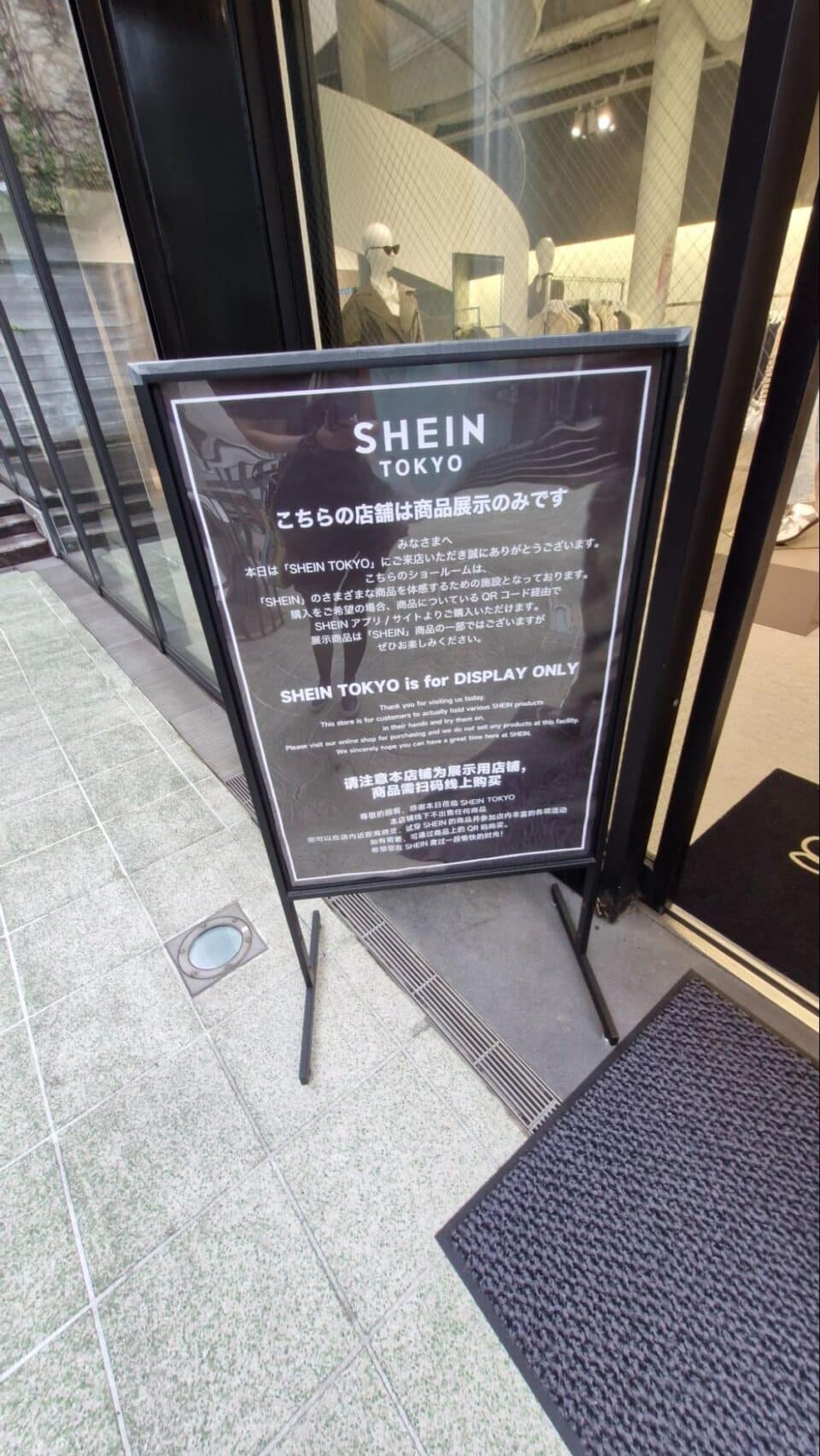

The Shein showroom in Tokyo’s fashionable Harajuku backstreets is exactly that. It is a showroom – you can’t buy anything in the store and take it away the same day.

Instead it’s a space that showcases a curated selection of products, which each have a QR code beside them that you can scan in the Shein app to place an order to your home or office.

The design of the store seems a deliberate attempt to alter the perception of Shein as a destination for cheap, low quality products.

A true physical representation of Shein’s endless online aisles would be a vast warehouse crammed with rails of product. The Shein showroom aims for a more premium interpretation with minimal products on display and an Instagrammable photo area (that gets visitors to do the brand’s marketing for it).

And this makes sense because the store isn’t actually a product showroom. It’s a brand showroom designed to make visitors think differently about Shein.

The specific products on display don’t matter as much as whether customers leave with a positive perception of Shein.

Legitimacy through location

Another interesting thing about the Tokyo showroom is its location.

As our own ever-insightful Jack Stratten noted on LinkedIn, what Shein wants more than anything is legitimacy. Hence its choice of partner in France (its proposed permanent stores are actually concessions in department stores owned by retail property group Societe des Grands Magasins (SGM)).

In Tokyo, the company is chasing legitimacy through its position off Cat Street, the go-to spot for cool, young locals now that Takeshita Street is a tourist haven, right next to Ometosando Hills which is packed with luxury brands.

The space straddles these two worlds, aiming to appeal to younger consumers who may be attracted to luxury/premium names but don’t have the budget for them, and also want to keep up with the latest trends.

An audience that department stores around the world would love to tap into, which is why you can see the appeal of the Shein deal for SGM.

Meanwhile, Shein gets to benefit from the legitimacy that entering renowned shopping areas and department stores gives its brand. Its presence in those spaces tells the customer that it’s more than a place to buy knock-offs or cheap tat.

Because physical retail has always been about legitimacy. There aren’t enough shopfronts in the world for every brand that pops up, so those that make it into a store automatically get a badge of ‘this must be alright’ in the eyes of consumers.

The case for this feels even stronger when you think about why Shein may have chosen Japan and France over other markets for permanent stores.

Weirdly, I’d say it might be because they’re some of the most difficult ones for Shein to win over.

Japan has a long-held reputation for purchasing based on quality, which isn’t what Shein is known for. A physical store where customers can interact with a curated range of products before they buy is one of the best ways to try to counter that view.

Meanwhile, France is helping lead the way in taking the fashion industry to task over its environmental impact. Shein’s reputation in the country has also taken a hit from two separate multi-million fines over website cookies, and misleading advertising and discounts.

There’s a sense that if Shein can change its brand perception in these markets, then it can succeed almost anywhere. The legitimacy of physical retail is a key strategic aspect of that.

Shein’s Trojan horse

The other main job of the Shein showroom in Tokyo is to drive usage of its app. The space is set up so that shoppers need to download the app to find out product information and order.

Likewise, during the recent Shein London pop-up at Future Stores’ Oxford Street space, all of the purchasable products also had a QR code attached encouraging shoppers to download the Shein app to scan them.

And once the Shein app is on a customer’s phone, Shein will be hoping that they keep using it shop – bypassing other channels that could send them to other retailers.

All we currently know of Shein’s intended spaces in France is that they are shop-in-shop concepts. Essentially smaller than the Tokyo showroom store.

So I can’t help but wonder if the company will adopt a mix of strategies for these concessions – a curated selection of products that can be purchased immediately (as with its pop-ups) while using the space to primarily drive uptake of its app.

If that’s the case, then Shein might be about to drop Trojan horses into some of France’s biggest department stores. Because while Shein’s presence may drive footfall to these stores, as a digital-first business it has no interest in keeping it there.

What it wants is digital footfall to its app, to its ecosystem. Physical retail in the right area, targeted at the right audience – as demonstrated in the Tokyo showroom – is one way of securing this.

Further evidence of this end goal showed up at the Shein London pop-up, which was plastered with messaging that said ‘search for your favourite brands on Shein’.

All of the products on display were from different Shein own brands, including Missguided which Shein acquired the rights to in 2023, positioning Shein not as a brand in its own right but as a platform for multiple brands. And multiple brands at different price ranges, as many visitors to the pop-up noted that the brands featured were typically more expensive than people were used to from Shein.

Kind of like a department store, really. Except Shein owns the brands and the store.

And it’s well on its way to owning the customers too.

Want the lowdown on the retail spaces that shed light on the big trends but everyone else overlooks? Talk to us about our monthly insights reports.