Why it’s time retail started measuring experience in-store

The retail store is a valuable – but untapped – data source for improving the customer experience.

All it takes is the right tools to measure everything from traffic to in-store journeys, so that you can take action to address pain points.

RetailNext is an in-store analytics platform expressly built to address the changing face of retail. Its solutions scale and evolve with your business with some impressive benefits.

We spoke to CEO and co-founder Alexei Agratchev about why small changes can add up to big benefits for retailers and why traffic is a more valuable measure than conversions.

Alexei Agratchev, CEO & Co-founder, RetailNext

What does RetailNext do?

We are a Silicon Valley based technology company focused on leveraging the latest and greatest technologies to help retailers measure and improve their in-store experience.

Our belief when we started the business was that brick-and-mortar retail is not going to go away. A lot has happened since then, but I certainly think that that has been proven – even in the last 18 months.

At the same time, our view was that if you’re going to compete as a brick-and-mortar retailer, it can’t just be based on product and price. You have to compete based on experience. And if you’re going to compete based on experience, you need tools to constantly measure and improve and optimise that experience.

How do you measure the experience in the store?

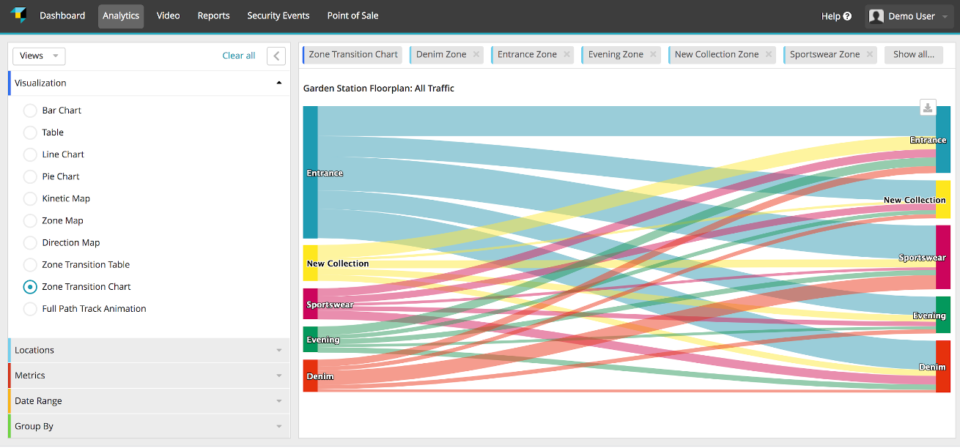

We measure how many people walk in the store, how much time they spend in the space, where they focus their time, what merchandise they interact with etc, as well as aggregated demographic data.

When you combine that with conversion data and repeat visits and other things, it gives you a really good indication of friction points. You can identify where people get stuck or confused, or if they abandoned their shopping and leave.

Retailers can also use the data to constantly just optimise the space, merchandising and the layout, and make sure the sales associates are in the right place at the right time.

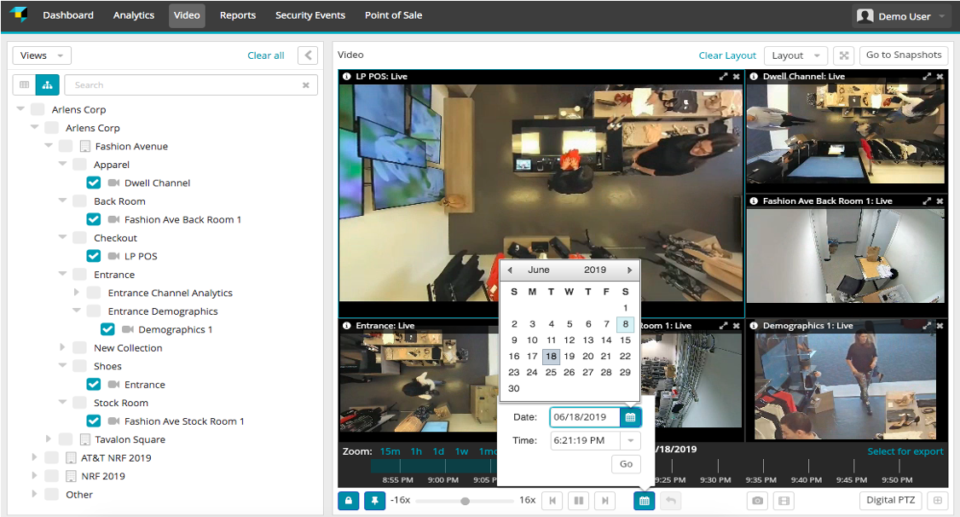

Can the store assistants access the information in real-time?

Yes, the platform lets you know when help is needed somewhere or gives you a certain view into where you need staff.

For example, you can look at your performance from the previous day and understand what happened. If you’re a regional manager who runs eight stores, and you get an alert saying ‘between 2 and 4PM, this store underperformed for where it should be’, within seconds you can see what was happening at that time.

You can see that your merchandise wasn’t set up properly in parts of the store. You can see there was a line at the checkout. The data is very actionable allowing retailers to make changes and learn from that. Your performance keeps improving because you keep removing things that are causing friction for your customers.

How does privacy factor into your solutions?

We’re a global company with deployments in hundreds of countries, including France, Switzerland, Germany, Australia and Japan, which are some of the most privacy forward jurisdictions in the world – both in terms of legality but also consumer attitudes towards privacy.

We have to build around that. Ninety-nine percent of what we do is aggregated anonymous data. It’s not about a person shopping. It’s about all the people shopping, identifying these bottlenecks and other issues. We’ve really invested in making sure that the data is anonymous and it’s impossible to trace it back to an individual.

There are use cases where retailers do identify individuals because the individual gives the retailer explicit permission to recognise them as they walk in the store, so they get something special in return.

I’ve never seen a brand secretly put something into their terms and conditions of their app so they can start tracking people because I think the downside outweighs the upside. But if you go to somebody and say, ‘if you download our app and opt in, when you walk in our stores you will be recognised and treated in a way that’s special’ that makes it worthwhile.

What impact does RetailNext have for retailers?

The thing about analytics and data is that it’s not magic. People have to respond to it, but the results are usually pretty amazing.

If you think about a typical specialty retailer that hasn’t invested in state-of-the-art traffic and predictive models, leveraging our system can improve the way you allocate your labour to increase sales by 6-8% on an annual basis.

That’s just for labour. We have a product called Retail Lab where you take a subset of your stores where you measure everything happening and then use those select stores to test new layouts, new merchandise concepts and new sales associate engagement programmes before you roll them out to the rest of the chain.

Sometimes minor improvements in layout can cause a dramatic change in sales. One client of ours had fixtures in the middle of the store floor and one the walls. After the store had been open for nine months, they asked the staff which fixtures drive more sales.

Everybody who worked in the store thought it was the floor fixtures, but when you looked at the data most of the engagement actually happened on the on the wall fixtures and the floor fixtures prevented people from navigating. They went from three of those floor fixtures to two, made them slightly smaller, and saw a 19% sales increase for the store.

In apparel retail, if you can get a person through a fitting room your ability to convert and average ticket sales go up. When you understand that you can make certain changes to navigation and layout, which will increase the number of visits to the fitting room. That has a huge impact.

For footwear retailers, if you get a person to sit down and try on several pairs of shows without any friction there is an almost 100% chance that they’re going to convert. It’s about figuring out the experience where you can make that happen and understanding what gets in the way.

One retailer we worked with had a subset of stores with very low conversions in the shoe department. They hadn’t realised that the benches for trying on shoes were a bit too close to the displays, so people couldn’t come and interact, and it created this weird environment.

Once we pointed this out, they moved the benches in and saw a double digit increase in sales.

When something is wrong it almost always shows up in the engagement and conversion data. Retail is a very powerful tool for any brand to acquire customers and engage, but only if it’s actually a good experience.

How many retailers are deploying these sorts of solutions?

I would say that less than 30% of stores worldwide have the right level of analytics and technology in the store. In speciality retail, such as apparel, footwear and jewellery, a large percentage have a good traffic counting system.

‘Good’ is important here as a lot of technology is so unreliable and inaccurate, which means that people don’t trust the data. Good traffic data is the most fundamental thing to understand, but when we first started the business we realised how few retailers had access to this.

A lot of retailers allocate their labour based on historical sales data rather than traffic, which means they don’t have enough labour and then sales are lower because they’re not converting. It’s a self-propagating thing

If you look at fast moving consumer goods like grocery retailers and drug stores, the majority of them don’t even have basic traffic analytics. It’s a huge opportunity for retailers to improve because many of them only focus on conversion – if someone goes into the drugstore they’re there to buy.

Even if the intention is there though we have seen that the execution matters. If the store isn’t well managed and there are products out of stock and lines at the checkout then conversion can drop by 20, 30, 40% sometimes. You don’t see that if you just look at sales.

What are the barriers to retailers adopting this sort of technology?

The technology is really good. The ability to deploy is really good. I think the biggest barrier is the change management involved for bigger retailers to introduce anything new.

We have a lot of customers that are digitally native companies and from the moment they start opening stores they use this data to run them. They can’t imagine living without this data.

But if you have a retailer that has 5,000 stores, tens of thousands of sales associates, thousands of store managers etc who have been doing their jobs without this data, introducing something new is pretty difficult.

It definitely pays off though.

We have a customer in Asia which is a 100-year-old company with 150 stores who got a new CEO who came in and deployed the system. But nobody was looking at the data because they’d been working the same way for 20 years. It took a real effort on his part in every meeting to ask people to report on the data and it took about 6-9 months for the entire organisation to adopt it.

Now they live and die by it. They look at it every day. It’s a core part of the way they run their business and the results have been dramatic in terms of performance.

I think the one silver lining of the Covid-19 pandemic and the impact on retail is retailers have had to adapt quickly. Before retailers were terrified of rolling out new things, because they thought if they did one project it meant they couldn’t do anything else, or it would be very complicated.

I think the success of deploying things like curbside collection during the pandemic has pushed their confidence level up. I think that’s a really positive thing for retail because retailers were always their own worst enemies.

We’ve put a lot of effort into making the adoption and usage of our tech easy. I think that’s made a big difference.

What’s next for RetailNext?

We’re always investing in ways to get better data cheaper. What’s happening with sensor technology and computer vision is really exciting in terms of what data we can gather.

The store will become a better source of data when it comes to learning about your customers. You can respond to customers better. We actually see now that brands open stores or partner with multi-brand retailers so they can learn more about their customers.

We’re also investing in ways to use the data to be more predictive and prescriptive.

How do we make it super obvious what a retailer should do with the data? We are building more and more of our experience into the system so it can make automatic recommendations.

I don’t think the sales associates will ever be replaced. I think in a world that’s increasingly digital the value of human interaction is exponentially higher. But I think there are going to be more and more tools where you can automate a non-selling task and you can give your sales staff really good tools to make them more effective.

Are you number one for your customers’ most important shopping missions? Book a call with one of our consultants today to discover what you can do right now to improve.